Intuit Helps Small Businesses with Kiva Zip Peer-to-Peer Lending

I’ve got some pretty exciting news to share with you. Are you ready? Intuit is doing something amazing to support small businesses like yours. They’re collaborating with Kiva Zip to bring you a unique lending opportunity!

Let me break it down for you. Kiva Zip is a platform that allows individuals like you and me to lend money directly to small businesses that need a little financial boost. And guess what? Intuit has teamed up with Kiva Zip to make this process even easier for small business owners like yourself.

But why is this even important? Well, let me tell you. Small businesses are the backbone of our communities. They create jobs, drive innovation, and add so much value to our lives. However, sometimes they face challenges when it comes to getting the necessary funds to grow and thrive. That’s where Kiva Zip steps in.

By participating in this peer-to-peer lending program, you become part of a community that supports small businesses. How cool is that? You have the power to help another entrepreneur pursue their dreams, just like you’re pursuing yours. It’s all about paying it forward.

And here’s the best part: the loans you make through Kiva Zip have zero interest rates. That means the small business owners won’t have to worry about paying back more than they borrowed. It’s a win-win for everyone involved.

Imagine the impact we can make together. By joining forces with Intuit and Kiva Zip, you’re not just supporting one small business. You’re contributing to a movement that empowers entrepreneurs and strengthens our economy.

So, what are you waiting for? Take a leap of faith and join me in this incredible endeavor. Let’s show the world what small businesses are made of. Together, we can make a difference.

I have some exciting news to share with you. Kiva, a really cool organization that helps people with starting their own businesses, joined forces with Intuit. You might know Intuit because they make popular software like Quicken, QuickBooks, and TurboTax.

Guess what? Thanks to a generous $50,000 donation from Intuit’s Financial Freedom Foundation, Kiva now has the ability to help even more small business owners. They can fund up to 500 small businesses every month through their special lending platform called Kiva Zip.

This initiative is a big deal because it’s all about breaking down financial barriers. It’s going to make a huge difference for small business owners and entrepreneurs who want to expand their businesses. I think it’s fantastic that Kiva and Intuit are teaming up to make such a positive impact!

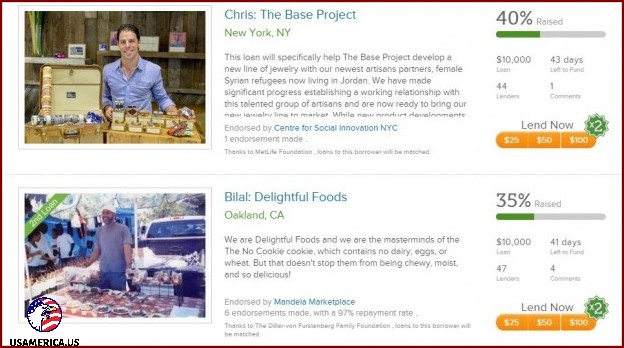

If you’re not eligible for Intuit’s regular loan programs, you can try something different. Create a profile on Kiva and raise money for your business. On Kiva Zip, their peer-to-peer lending platform, you can borrow anywhere from $5,000 to $10,000.

Kiva has been in the micro-lending business for a long time. In 2014, they launched Kiva Zip across the U.S. They joined forces with corporate partners and city governments to gather around $10 million in interest-free loans through crowdfunding.

I’m really excited about partnering with Kiva Zip to help small businesses get the money they need to start and grow, said Jeffrey Kaufman, the leader of QuickBooks Financing at Intuit, in a TriplePundit post. This platform is a lifeline for small businesses that previously had no options or very limited opportunities for funding. And the donation from the Intuit Financial Freedom Foundation is our way of supporting small businesses all over the country and giving them a chance to succeed.

Kiva allows people to give small loans, as little as $25, to entrepreneurs online. They show all the people who need loans, share their pictures, and tell their stories. Then, lenders can choose the entrepreneur they want to support and decide how much money they want to give them.

No need to worry about scary interviews or a credit check. With Kiva, it’s all about credit and character. Here’s how it works: I invite my friends and family to help me raise funds for my business. Once we reach a certain goal, Kiva features my business on their website, where I can get even more money. The best part? I get to choose a payment plan that works for me. And once I’ve paid back my loan, I can apply for more if I need it.

In today’s world, it’s becoming harder and harder for small business owners to get a loan from a bank. But thankfully, there are sites like Kickstarter, GoFundMe, and Kiva that make it easier for us to get the funding we need.

I’ve worked with these two organizations before – not once, but twice! Way back in 2010, they made a big announcement about expanding their project aimed at helping small businesses grow. They called it an aggressive matching program, which sounds pretty intense!