Get a Tax Break by Purchasing a Truck or SUV before the End of the Year

Did you know that there’s a way you can save some money while buying a new truck or SUV? It’s true! And it’s all thanks to a special tax break. But wait, what exactly is a tax break? Well, it’s a way for the government to give you a discount on your taxes. And in this case, you can get a tax break if you buy a truck or SUV before the end of the year.

Now, you might be wondering why buying a truck or SUV would give you a tax break. That’s a good question. You see, the government wants to encourage people to buy vehicles that are good for the environment. And trucks and SUVs that meet certain criteria are considered environmentally friendly. So, if you buy one of these vehicles, the government will give you a tax break to reward you for making a green choice.

But how do you know if a truck or SUV qualifies for the tax break? Well, there are a few things you need to keep in mind. First, the vehicle has to weigh a certain amount. Second, it needs to have a certain kind of engine. And finally, it needs to meet certain fuel economy standards. If the vehicle meets all of these criteria, congratulations! You can enjoy a tax break.

So, why should you take advantage of this opportunity and buy a truck or SUV before the year ends? Well, not only will you be saving money on taxes, but you’ll also be getting a brand new vehicle. It’s a win-win situation! And who doesn’t love a good deal?

Now, remember, this tax break is only available until the end of the year. So, if you’re in the market for a new truck or SUV, now is the time to act. Don’t miss out on this chance to save some cash. Go ahead and treat yourself to a new set of wheels and enjoy the benefits of a tax break. Happy shopping!

Hey, did you know that if you buy a big truck, SUV, or another vehicle for your business, you can deduct the entire purchase price from your taxes? That’s right! According to the IRS, you can write off 100% of the cost as a tax deduction. And guess what? You still have time to take advantage of this for the 2020 tax year!

If you own a small business, you can deduct the full price of a business vehicle if it weighs more than 6,000 pounds. We determine the weight based on something called the Gross Vehicle Weight Rating (GVWR), which is an industry standard.

The best part is, if your vehicle qualifies for the full deduction, you don’t have to spread it out over several years. You get the entire deduction in one year, which means big savings on your taxes!

So, there’s this rule that used to be called the Hummer Loophole. Congress got rid of it a while back, but then the Tax Cuts and Jobs Act of 2017 brought back a similar version in 2018. It’s a bit complicated, but I’ll break it down for you.

Contents

What you need to qualify:

- Buy before December 31, 2020: To take advantage of the 100% deduction, you need to buy the vehicle and have it ready for use by the end of 2020, no later than December 31, 2020.

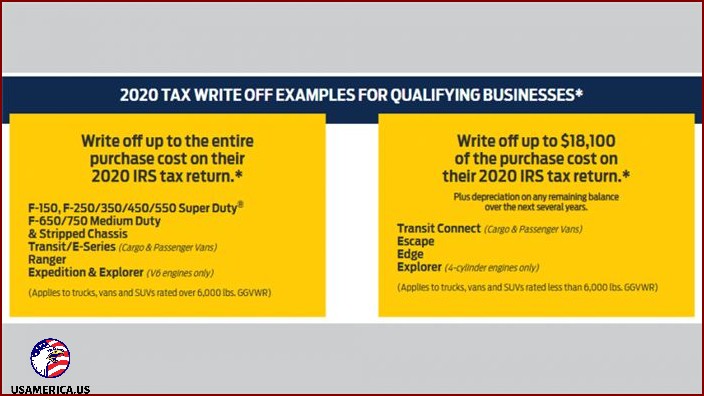

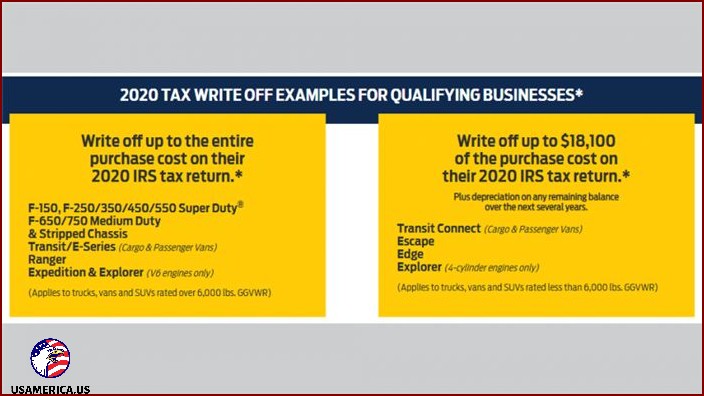

- Qualifying for the 100% Deduction: If you’re using a business vehicle like a big pickup truck, cargo van, or large SUV that has a GVWR (Gross Vehicle Weight Rating) of over 6,000 pounds, you might be eligible for a full deduction. In North America, you can find the GVWR label inside the driver’s door, close to the latch. Just be aware that different option packages can affect the GVWR, so always check the label on the actual vehicle you’re purchasing. Refer to the chart below for a partial list of vehicles that qualify based on their weight.

- Using the Vehicle for Business: To qualify for deductions, the vehicle must be used for business purposes at least 50% of the time. If you also use it partially for personal use, you can only deduct the percentage that is used for business purposes. Simply multiply the purchase price by the percentage of business use (ranging from 51% to 100%).

What About Light Trucks and Cars?

Understanding How Depreciation Works

When it comes to certain purchases, like a heavy truck, the IRS requires that any amount over $18,100 be spread out and deducted over a period of time. This is known as depreciation.

The Value of a Tax Break

But what does it mean when we say you can deduct the full amount? It doesn’t mean you can directly subtract the purchase price from your income tax liability. It’s a bit more complex than that.

Here’s how it works: you need to know your tax bracket, which determines your marginal rate. To figure out the value of the tax break, you multiply the purchase price by your marginal rate.

For example, let’s say the purchase price of a heavy truck is $95,000, and you’re in the 24% tax bracket. To get a quick estimate of how much you’ll save, you can multiply $95,000 by 0.24 (which is the same as 24%). The result is $22,800.

So, if everything goes smoothly, your deduction could potentially reduce your taxes by $22,800 for the year 2020. Not too shabby!

I want to let you know about some awesome deductions you can make when it comes to your taxes. In addition to the Section 179 and Bonus Depreciation deductions, did you know that you can also deduct the mileage costs for using your vehicle? It’s true! Make sure to check out the 2020 IRS mileage rates for more information.

By the way, if you’re interested in exploring more deductions for your small business, you should take a look at the Top Small Business Tax Deductions.

Now, here’s something important to keep in mind – tax rules can be a bit complicated, and there are always exceptions and exclusions. That’s why it’s a good idea to consult with a tax advisor who can guide you based on your specific situation and any limitations that may apply.

Here’s a List of Heavy Trucks and SUVs That Qualify

Let’s start with BMW:

- BMW X5 M

- BMW X5 XDrive35I

- BMW X6 M

- BMW X6 XDrive35I

- All models of BMW X7

- Now, let’s move on to Buick:

- Buick Enclave 2WD

- Buick Enclave 4WD

- Next up, we have Cadillac:

- Cadillac Escalade 2WD

- Cadillac Escalade AWD

- Cadillac XT5

- Cadillac XT6

Lastly, let’s not forget about Chevrolet:

- Chevrolet Colorado 2.8L AWD

I have a list of different vehicles for you to consider. They include the Silverado C1500, Silverado C2500, Silverado C3500, Silverado K1500, Silverado K2500, Silverado K3500, Suburban C1500, Suburban K1500, Blazer, Tahoe 2WD LS, Tahoe 4WD LS, Tahoe Hybrid, Traverse 2WD, Traverse 4WD, Chrysler Pacifica, Chrysler Pacifica Hybrid, Dodge Durango 2WD, Dodge Durango 4WD, Dodge Grand Caravan, Ford Expedition 2WD, Ford Expedition 4WD, Ford Explorer 2WD, Ford Explorer 4WD, Ford F-150 and larger 2WD, Ford F-150 and larger 4WD, and Ford Flex AWD. In addition, there are GMC vehicles like the GMC Acadia 2WD and GMC Acadia 4WD. Take your time and choose the one that suits you best.

I want to tell you about some cool cars that I found. Check out this awesome list:

- I found a few GMC Sierra models that caught my eye. There’s the GMC Sierra C1500, the GMC Sierra C2500 HD, and the GMC Sierra C3500 HD. They all sound pretty powerful!

- Oh, and I can’t forget about the GMC Sierra K1500, the GMC Sierra K2500 HD, and the GMC Sierra K3500 HD. They’re all part of the Sierra family and they sound really tough!

- Next up, we have the GMC Yukon. There’s the GMC Yukon 2WD, the GMC Yukon 4WD, and even the GMC Yukon Hybrid. They all sound like they’re ready for an adventure!

- And don’t forget the GMC Yukon XL. There’s the GMC Yukon XL C1500 and the GMC Yukon XL K1500. They’re both big and spacious!

- Now, let’s move on to Honda. I found the Pilot 4WD, the Honda Odyssey, and the Honda Ridgeline AWD. They all sound like great options!

- If you’re into Jeeps, you’ll love the Jeep Grand Cherokee and the Jeep Gladiator Rubicon. They both sound like they can handle any terrain!

Now, let’s talk about Land Rover.

- I found the Range Rover 4WD, the Range Rover SPT, the Discovery, and the Defender. They all sound so rugged and capable!

- If you’re interested in a Lincoln, check out the Lincoln MKT AWD, the Lincoln Navigator, and the Lincoln Aviator. They all sound super luxurious!

- And last but not least, we have Mercedes-Benz. You might like the Mercedes-Benz G550, the Mercedes-Benz GLS, and the Mercedes-Benz GLE. They all sound really fancy!

Welcome to the world of cars!

Let’s explore some popular car models together:

Nissan

- I’m excited to introduce you to the Nissan Armada 2WD, a fantastic car for your adventures.

- If you prefer a four-wheel drive, the Nissan Armada 4WD will be a great choice for you.

- For those in need of a capable cargo van, look no further than the Nissan NV 1500 S V6.

- The Nissan NVP 3500 S V6 is another excellent option if you’re looking for a versatile van.

- If you’re interested in a powerful pickup truck, check out the Nissan Titan 2WD S.

Next, let’s discover what Ram has to offer:

- The Ram Promaster 1500-3500 is a series of reliable and spacious vans.

- If you’re in the market for a pickup truck, the Ram 1500 and up models are worth considering.

Now, let’s turn our attention to Tesla:

- The Tesla Model X is an impressive electric SUV that combines elegance with sustainability.

Lastly, let’s see what Toyota has in store:

- If you’re looking for a luxurious and powerful SUV, the Toyota 4Runner 2WD LTD is a great option.

- The Toyota 4Runner 4WD LTD offers the same luxury with the added benefit of four-wheel drive capability.

- For those seeking the ultimate off-road experience, the Toyota Landcruiser is a legendary choice.

- The Toyota Sequoia 2WD LTD is a spacious and comfortable SUV for all your family adventures.

- If you need extra traction and control, consider the Toyota Sequoia 4WD LTD.

- The Toyota Tundra 2WD is a capable and reliable pickup truck that can handle any task.

- Similarly, the Toyota Tundra 4WD provides exceptional off-road capability with its four-wheel drive system.

There you have it – a diverse range of cars to suit different needs and preferences. Happy exploring!