30 PayPal Alternatives Perfect for Small Businesses

Are you a small business owner looking for payment options beyond PayPal? Well, you’ve come to the right place! I’m here to introduce you to 30 fantastic alternatives that can meet your needs. Let’s dive in!

Contents

- 1 1. Stripe

- 2 2. Square

- 3 3. Google Pay

- 4 4. Amazon Pay

- 5 5. Shopify

- 6 6. QuickBooks Payments

- 7 7. WooCommerce

- 8 8. Authorize.Net

- 9 9. Braintree

- 10 10. Venmo

- 11 11. 2Checkout

- 12 12. Payoneer

- 13 13. Dwolla

- 14 14. Payza

- 15 15. WePay

- 16 16. Skrill

- 17 17. Square Cash

- 18 18. Payline

- 19 19. BlueSnap

- 20 20. GoCardless

- 21 21. PayLeap

- 22 22. PaySimple

- 23 23. Paytm

- 24 24. Square Register

- 25 25. Zelle

- 26 26. Paymate

- 27 27. PayU

- 28 28. Alipay

- 29 29. Payzaar

- 30 30. Amazon WebPay

- 30.1 Google Wallet

- 30.2 Stripe

- 30.3 Venmo

- 30.4 Amazon Payments

- 30.5 Square

- 30.6 Payline

- 30.7 Payza

- 30.8 Payza

- 30.9 Skrill

- 30.10 WePay

- 30.11 Authorize.net

- 30.12 Intuit

- 30.13 Now, let me tell you about Shopify Payments.

- 30.14 But wait, there’s more!

- 30.15 Now, let’s talk about Worldpay.

- 30.16 Alright, next up we have Charge.com.

- 30.17 And let’s not forget about 2Checkout!

- 30.18 Last but not least, we have Popmoney.

- 30.19 Check out Paymate!

- 30.20 Discover Payoneer!

- 30.21 Dwolla

- 30.22 Braintree

- 30.23 Paysera

- 30.24 PayLane

- 30.25 Wirecard

- 30.26 BlueSnap

- 30.27 Welcome to Merchant Inc

- 30.28 Discover Selz

- 30.29 Introducing Viewpost

- 30.30 Viewpost

- 30.31 Fastspring

- 30.32 Avangate

1. Stripe

Stripe is a popular choice among small businesses. It offers a seamless payment experience and supports credit card payments from customers all around the world.

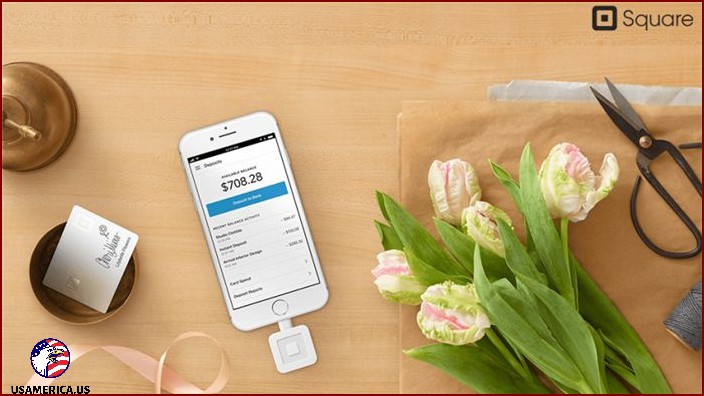

2. Square

If you have a traditional brick-and-mortar store, Square is an excellent choice. It provides a compact, easy-to-use card reader that plugs into your smartphone or tablet, allowing you to accept payments on the go.

3. Google Pay

With Google Pay, your customers can make payments using their Google account, making the process quick and convenient. It’s a great option if your customers are tech-savvy.

4. Amazon Pay

Many people trust and use Amazon for their online shopping. By offering Amazon Pay, you enable your customers to effortlessly check out using their Amazon accounts, providing a sense of familiarity and security.

5. Shopify

If you run an online store, Shopify is a comprehensive e-commerce platform that offers integrated payment solutions. It’s a one-stop-shop for managing your inventory, marketing, and accepting payments.

6. QuickBooks Payments

As a small business owner, managing your finances is crucial. QuickBooks Payments not only handles your payments efficiently but also seamlessly integrates with your accounting software, making your life a whole lot easier.

7. WooCommerce

WooCommerce is a popular WordPress plugin that transforms your website into an online store. With WooCommerce, you can choose from a wide range of payment gateways to suit your business needs.

8. Authorize.Net

Authorize.Net is a robust payment gateway that supports various payment methods, including credit cards and e-checks. It’s an excellent option for businesses that require flexibility in accepting payments.

9. Braintree

Owned by PayPal, Braintree offers a seamless and secure payment experience for both online and offline businesses. It supports popular payment methods and provides advanced fraud protection.

10. Venmo

If your target audience consists mainly of millennials, Venmo is a must-have payment option. It allows users to easily send and receive payments, making it popular among friends splitting bills or sharing expenses.

11. 2Checkout

2Checkout is a global payment processor that accepts multiple payment methods, including credit cards, PayPal, and more. It offers a user-friendly interface and supports international transactions.

12. Payoneer

Payoneer is a great choice for businesses that operate on a global scale. It provides a secure and convenient way to send and receive payments across borders, with flexible withdrawal options.

13. Dwolla

Dwolla offers a unique approach to payment processing. With its powerful API, you can create custom payment solutions tailored to your business. It’s an ideal option for businesses that require high flexibility.

14. Payza

Payza is a global online payment platform that supports various payment methods. It enables businesses to send and receive payments securely, making it a popular choice for international transactions.

15. WePay

Designed specifically for crowdfunding and marketplace platforms, WePay boasts a powerful payment API. It provides seamless payment integration and advanced fraud protection.

16. Skrill

Skrill is an international digital wallet that allows you to send and receive money online. It supports over 40 currencies and offers a quick and secure way to manage your payments.

17. Square Cash

With Square Cash, you can easily send money to friends and family. It’s a simple and user-friendly payment app that can also be used for paying vendors or receiving payments from your customers.

18. Payline

Payline is a versatile payment solution that caters to businesses of all sizes. With its range of services, you can accept payments in-store, online, and even over the phone.

19. BlueSnap

BlueSnap offers a comprehensive payment platform that supports global transactions. It provides features like subscription billing, mobile wallet integration, and fraud prevention tools.

20. GoCardless

If you deal with recurring payments, GoCardless is an excellent choice. It specializes in direct debit payments, making it easy for you to collect payments on a regular basis.

21. PayLeap

PayLeap is a payment gateway that combines seamless payment processing with robust security measures. It allows you to customize your checkout experience and offers advanced reporting.

22. PaySimple

PaySimple lives up to its name by making payment processing simple for small businesses. It offers features like recurring payments, invoicing, and customer management.

23. Paytm

Paytm is one of the leading digital payment wallets in India. It enables businesses to accept payments using mobile wallets, UPI, and other popular payment methods.

24. Square Register

If you’re looking for an all-in-one payment solution, Square Register is the way to go. It combines a powerful point-of-sale system with built-in payment processing, making it perfect for retail businesses.

25. Zelle

Zelle allows users to send money directly between bank accounts within minutes. It’s a convenient option for businesses that need to make quick payments or share funds with partners.

26. Paymate

Paymate offers an easy way to accept payments online or by phone. It provides a secure payment gateway and enables businesses to streamline their payment processes.

27. PayU

PayU is a leading online payment service provider that supports businesses around the world. It offers a range of payment options and supports multiple currencies.

28. Alipay

Alipay is a popular digital payment platform in China and a great option if you have customers in the Chinese market. It allows users to make payments using their smartphones.

29. Payzaar

Payzaar offers an integrated payment solution for businesses. It provides features like secure payments, international bank transfers, and customizable checkout pages.

30. Amazon WebPay

Designed for individuals and small businesses, Amazon WebPay allows you to send and receive money using your Amazon account. It’s a convenient option with no additional fees.

There you have it! Thirty amazing PayPal alternatives for your small business. Feel free to explore these options and choose the one that suits your unique needs. Happy payments!

If you make a purchase using the links provided, we may receive a commission. To find out more, read on.

I want to talk to you about PayPal. It’s a really useful tool for businesses that want to handle their payments, send invoices, and keep track of their finances online. But did you know that there are other options out there? If you’re looking for a replacement for PayPal or just want to have more choices, I’ve got 30 alternatives for you.

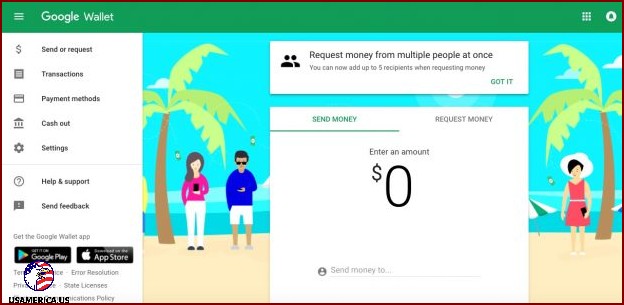

Let’s start with Google Wallet. It’s a popular option that allows you to send and receive money easily. You can also use it to make purchases online and in stores. It’s a great alternative to PayPal that offers a lot of flexibility.

Next up, we have Venmo. This app is really popular among young people, and it’s a great way to send money to friends and family. You can also use it to make purchases at participating merchants. It’s a fun and easy option that’s worth considering.

Another option to consider is Square. This is a really versatile tool that allows you to accept payments in person, online, and on the go. They offer a variety of payment solutions that can be tailored to your specific needs. It’s a reliable choice that many businesses love.

If you’re looking for a more international option, then Payoneer might be the right choice for you. They offer a global payment service that allows you to receive and withdraw funds in multiple currencies. It’s a great option if you have customers or clients all over the world.

For those of you who are focused on e-commerce, Stripe is a popular choice. They offer a simple and secure way to accept payments online. They have a lot of great features for businesses, including the ability to create custom payment forms and manage subscriptions. It’s definitely worth checking out.

If you’re into cryptocurrency, then Coinbase is the option for you. They are a leading platform for buying, selling, and storing digital currencies. It’s a secure and reliable option if you’re interested in this new form of payment.

Those are just a few of the alternatives to PayPal that are available for small businesses. There are many more options out there, so I encourage you to explore and find the one that works best for you. Remember, PayPal is great, but it’s not the only option.

I wanted to tell you about some cool apps and platforms that make it super easy to handle your money and payments.

Google Wallet

Have you ever wanted to send money to your friends or family without having to go through all the hassle of writing checks or using cash? Well, with Google Wallet, you can do just that! It’s an awesome app and web platform that lets you send and receive money using your email address and phone number. And guess what? You can even connect it to your bank account and keep track of your expenses and payments over time. How convenient is that?

Stripe

Now, let’s talk about Stripe. It’s a super cool software platform that lets you accept credit card payments online. Whether you’re running a small business or selling stuff on the internet, Stripe has got you covered. You can easily set it up to accept one-time payments or even subscription payments. Plus, it’s customizable, so you can make it work perfectly for your specific business needs. How amazing is that?

Venmo

Have you ever been out with your friends, and you all decided to split the bill? It can get pretty tricky, right? Well, Venmo is here to save the day! It’s a popular platform that lets you send money and share expenses with your friends. But guess what? It’s not just for personal use. If you’re a business owner, you can make it easier for your customers to make purchases using Venmo, especially if they’re using mobile devices or social media apps. How convenient is that?

Amazon Payments

Let me tell you about Amazon Payments. It’s a cool way for online stores to accept payments using Amazon’s online platform. If you’ve got your payment info saved on your Amazon account, you can easily use that same method in other stores that use Amazon Payments. Pretty convenient, right?

Square

Now, let me introduce you to Square. Square is known for helping businesses accept credit card payments in person. But guess what? They also offer tools for online stores and appointment-based businesses. When it comes to transaction fees, they start at 2.75 percent. Not bad at all!

Payline

Next up is Payline. They’ve got a variety of options for processing payments, whether it’s for mobile, online, or in-store purchases. Their fees start at just 20 cents per transaction plus 5 percent overall. Affordable and flexible!

Payza

I’m here to tell you all about some awesome payment platforms. Let’s dive right in!

Payza

Payza is a super handy payment platform that works with credit cards, bank accounts, Bitcoin, and much more. It’s perfect for businesses that sell stuff online, and they even have a cool Payza card that makes buying things even easier for you. The best part? Opening an account and sending money is absolutely free! And don’t worry, there are only a few small fees when it comes to transactions and processing Bitcoin.

Skrill

Skrill is a digital payment platform that’s super helpful for online merchants, app developers, and game creators. If you want to accept payments and make your customers happy, Skrill has got your back.

WePay

Now, let me introduce you to WePay – an awesome integrated payment platform designed to make your life easier. With WePay, you can accept payments from your customers, send invoices, and even handle fancy things like marketing automation. Talk about convenience!

Authorize.net

For businesses that accept payments in-store, online, or on-site, Authorize.net is the way to go. They provide all the tools you need for smooth payment processing. Plus, their pricing starts at just 2.9 percent plus 30 cents per transaction. Not too shabby!

Intuit

Did you know that QuickBooks, created by Intuit, gives businesses like mine the power to send invoices and receive payments from anywhere? It’s super convenient! Oh, and the best part is that the fees are super affordable, starting at just 25 cents per transaction plus 2.4 percent.

Now, let me tell you about Shopify Payments.

If you happen to run a Shopify ecommerce store, Shopify Payments is the perfect solution for accepting payments online. But guess what? They also have a point-of-sale (POS) system for businesses like yours and mine that need to accept payments in person. How awesome is that?

But wait, there’s more!

Looking for a convenient way to accept payments? ProPay has got you covered! Whether you run a small business or a big enterprise, they offer payment solutions tailored just for you. From credit card payments to bank transfers, and even mobile payments, they’ve got all bases covered.

Now, let’s talk about Worldpay.

Worldpay is a global payment platform that lets you accept payments both online and in person. No matter where your customers are, they’ve got you covered. They work with all kinds of currency and even provide data and optimization tools to help grow your business. Pretty cool, right?

Alright, next up we have Charge.com.

Charge.com is a credit card processing platform that makes accepting payments a breeze. The best part? No setup fees or contracts! Whether you want to accept payments online or in your physical store, they’ve got you covered.

And let’s not forget about 2Checkout!

2Checkout is an awesome online payment processing platform for all your business needs. Their mobile-friendly hosted checkout ensures a smooth payment experience for customers, and their advanced security measures keep everything safe and sound. Plus, with their global reach, you can accept payments from customers all around the world. Pricing starts at 2.9 percent and 30 cents per transaction.

Last but not least, we have Popmoney.

Wanna know something cool? I can show you how to send, request, and receive money online or on your mobile device with Popmoney. It’s super convenient! If you’re a business person who has specific clients, Popmoney is a great tool for you. It’s got a simple pricing plan too – just 95 cents per transaction. No hidden fees or complicated stuff!

Check out Paymate!

If you run a business and need a way to accept credit card payments, Paymate is your go-to friend. It’s got everything covered – online payments, in-person transactions, and even phone payments. You can accept payments in different currencies too, how neat is that? And with Paymate, you also get support and dispute resolution services. So, you’re in good hands all around!

Discover Payoneer!

When it comes to sending money internationally, Payoneer is the expert. With Payoneer, you can easily bill your customers, make bank transfers, and manage your accounts.

Dwolla

Now, let me tell you about Dwolla. Dwolla is a handy tool that developers can use to build applications for bank transfers and managing purchases and customers. You can either use Dwolla’s interface to quickly make transfers or integrate their API into your own interface.

Braintree

Alright, listen up! Braintree, which is actually a service provided by PayPal, is all about helping businesses accept, process, and split payments. They’ve got different solutions for all kinds of businesses, whether you’re a marketplace or offering direct services.

Paysera

Now, here’s something interesting. Paysera offers affordable money transfers and a platform for accepting online and mobile payments. It’s free to sign up, and merchants only pay fees for services like checkout and e-banking.

PayLane

Have you heard of PayLane? It’s a super handy online payment system designed just for SaaS and ecommerce businesses like yours. With PayLane, you can accept payments in all sorts of different ways and currencies. Isn’t that cool?

Wirecard

Now let me tell you about Wirecard. They offer a whole bunch of fantastic payment solutions for all kinds of merchants and businesses. Their products include everything from payment processing to mobile payment options and even risk management tools. They’ve got you covered!

BlueSnap

Oh, and how can I forget BlueSnap? They’re another awesome option for your payment needs. Like PayLane and Wirecard, they provide top-notch services for merchants and businesses. So, whether you need payment processing or other payment solutions, BlueSnap has got your back!

BlueSnap makes it easy for online stores and developers to handle payments. With BlueSnap, you can accept credit cards, bank transfers, or use popular online accounts like PayPal.

Welcome to Merchant Inc

At Merchant Inc, we specialize in providing credit card processing solutions for businesses that accept payments online, in person, or over the phone. Our fee is 1.99 percent, plus an additional 25 cents per transaction.

Discover Selz

Selz is a fantastic tool for businesses that want to process payments from their online stores or social media platforms. With Selz, you can create your own online store and even sell products on social media. You can easily process payments with Selz Pay or use other payment platforms like PayPal.

Introducing Viewpost

I want to tell you about some really cool tools that can help you with your business finances. They’re like superheroes that make sending invoices, getting payments, and managing cash flow a breeze!

Viewpost

So let me introduce you to Viewpost. It’s an awesome solution that lets you send invoices, accept payments securely, and keep track of your cash flow. The best part? You can accept electronic payments for free! They only charge small fees for sending payments and other actions.

Fastspring

Now, let’s talk about Fastspring. It’s a digital commerce platform specifically designed for software and SaaS businesses. With Fastspring, you can easily enable online payments or payments within apps. They offer different plans, including a pay-as-you-go option and business plans with flat monthly fees starting at just $199 per month.

Avangate

Last but not least, we have Avangate. This payment solution is perfect for software developers. The pricing depends on your specific needs and the plan you choose for your business.

So there you have it! These tools can really make a difference in your business by taking care of your finances and helping you get paid quickly and securely. Give them a try and see how they can streamline your business operations!